Wrong Currency For Accounts In Quicken For Mac 2015

Am using Quicken 2015 with windows 8. When I reconcile an account the payment does not transfer to the reconcile screen and thus have nothing to reconcile the charges to. Also in my main checking account any deposits I make or manage transactions I make are taken in but not shown on the screen no.

• Back • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • •. Tax corporation for mac 2016.

As the maker of Quicken (Intuit) moves toward improving its products, services, and security, the retirement of older versions of software is necessary. Generally we support the most current year plus two previous years of software. This ensures that resources are available to bring you the best possible products and customer service. Use this table to determine if your version of Quicken software is retiring or has already retired. It's important to upgrade by the retirement date to continue downloading without interruption. Investment and Insurance Products Are: • Not Insured by the FDIC or any Federal Government Agency • Not a Deposit or Other Obligation of, or Guaranteed by, the Bank or Any Bank Affiliate • Subject to Investment Risks, Including Possible Loss of the Principal Amount Invested Wells Fargo Advisors is a trade name used by Wells Fargo Clearing Services, LLC (WFCS) and Wells Fargo Advisors Financial Network, LLC, Members, separate registered broker-dealers and non-bank affiliates of Wells Fargo & Company. WellsTrade ® and Intuitive Investor ® accounts are offered through WFCS.

Links to third-party websites are provided for your convenience and informational purposes only. Wells Fargo Advisors is not responsible for the information contained on third-party websites.

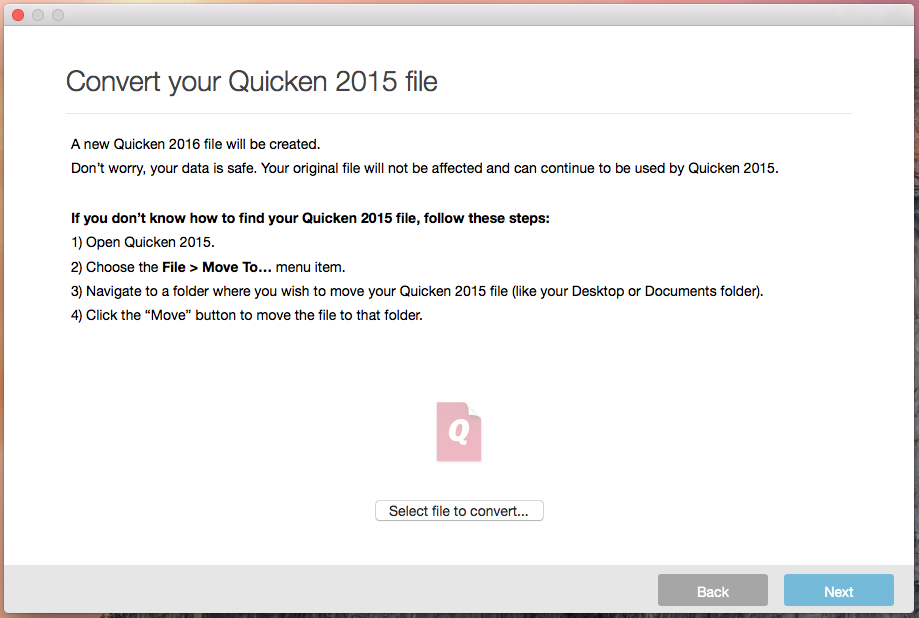

Click to expand.Updating from 2011 was terrible. It took me six and a half hours. Well, leaving out the details, since I've spent enough time on this today: (1) After updating, Quicken wouldn't accept my password. I knew I had it right because I use a password vault & copied it through the clipboard, both when creating the password and entering it later. (2) Their password removal tool wouldn't accept my account balances, which I also copied through the clipboard from the financial institutions' sites (plural because when1 institution wouldn't work I tried another. (3) I restored a backup, being double-extra careful about the password. The data seemed to update OK but I had the same problem with the password.

Finally, I figured out that Quicken was loading the wrong data file. When I manually browsed to the location in which I had told Quicken to store the converted data, the problem went away. I thought I was home free, but that was only 2 of the 6.5 hr. When I tried the on-line data update, Quicken imported hundreds of transactions for accounts I no longer use. I had reorganized my own accounts in the past, grouping them differently and abandoning the prior groupings.

In other cases, I stopped using Quicken to track specific accounts because the broker's reports were all I needed. OK, I can understand why Quicken did these things, but why didn't it give me a way to let me delete downloaded transactions as a group, rather than clicking Edit then Delete for each one? Why couldn't I retire an account without taking all of the securities & cash out of it, when I had only stopped managing someone else's money? Why did it insist on putting all of these obsolete accounts on the sidebar? OK, the accounts could be put in the 'separate' group, but they weren't separate, they were obsolete.

Why couldn't I disable connection to my financial institution without accepting downloaded transactions? Finally, after a lot of experimenting, I entered phony transactions to zeroout the obsolete accounts and closed them, or deleted accounts if I didn'tneed to save the history, or manually deleted downloaded transactions individually and disconnected the account, or hid unwanted accounts -- different cases called for different workarounds. Part of the problem was that Quicken discovered accounts at my financial institution which I didn't want it to track. There should have been a way to tell it 'track only these.' Incidentally, it loads and backs up slowly too.

PlumTree wrote: 'Updating from 2011 was terrible. It took me six and a half hours.

I figured out that Quicken was loading the wrong data file'. ------------------------------------------------------------------- Quicken tries to convert the last file you had open before you started the conversion. ------------------------------------------------------------------------------------------------ 'When I tried the on-line data update, Quicken imported hundreds of transactions for accounts I no longer use.' ------------------------------------------------------------------------- How, exactly, would Quicken know you did not use the accounts any more? ------------------------------------------------------------------------------------------------- 'OK, I can understand why Quicken did these things, but why didn't it give me a way to let me delete downloaded transactions as a group, rather than clicking Edit then Delete for each one?'